Irs.Gov 2024 Stimulus Check

Irs.Gov 2024 Stimulus Check. The internal revenue service (irs) will handle the. How to claim a missing payment you may be eligible to claim a recovery rebate.

The law expanded the property tax/rent rebate to provide a larger. Understanding how much social security checks will increase is important for all beneficiaries across the country since they rely on these payments to cover their housing, food, health care,.

Ctc Monthly Payments 2024 From The Irs Are Expected To Go Into Impact Beginning On July 15, 2024, For All Eligible Individuals.” The Post Received Nearly 100 Shares In Just Over A Week.

The irs updates the app overnight, so if you don't see a status change, check back the following day.

The Recovery Rebate Credit Is A Refundable Credit For Those Who Missed.

However, people who are missing stimulus.

Irs.Gov 2024 Stimulus Check Images References :

Source: ivonnesandye.pages.dev

Source: ivonnesandye.pages.dev

Stimulus Check 2024 Update Today For Seniors 2024 Tiff Tiffie, The irs updates the app overnight, so if you don't see a status change, check back the following day. The irs has announced that eligible individuals, particularly new parents from 2021, can still claim $1400 stimulus checks by filing their tax returns by may 17, 2024.

Source: juliannewkerri.pages.dev

Source: juliannewkerri.pages.dev

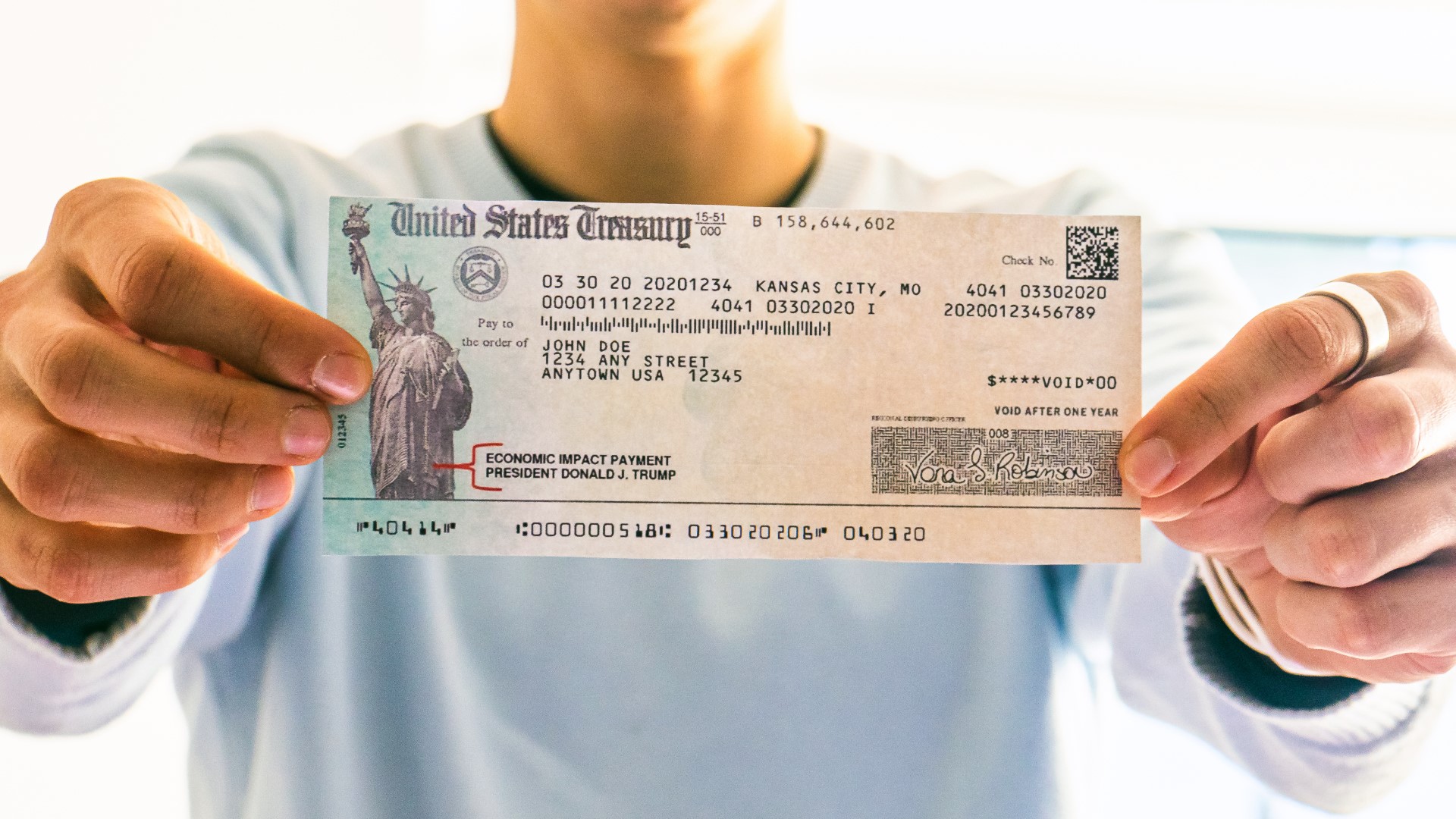

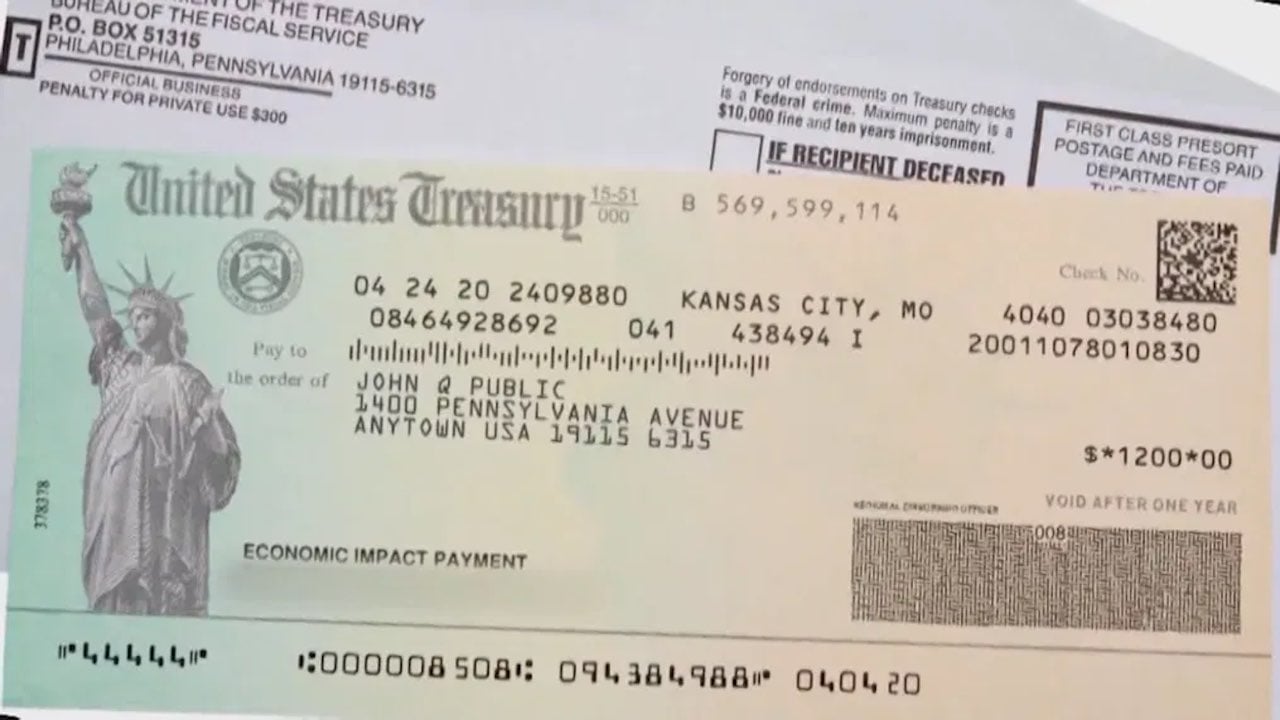

Irs 6400 Stimulus Check 2024 Tommy Gretchen, Most eligible people already received their economic impact payments. First, americans should keep their eyes out for any leftover stimulus check money that they were owed for the 2020.

Source: zsazsawdulce.pages.dev

Source: zsazsawdulce.pages.dev

2024 Stimulus Check Update Approved By Irs Login Tally Felicity, Department of the treasury and irs announced today that 159 million economic impact payments, worth more than $267 billion, have been distributed to americans. The deadlines to file a return and claim the 2020 and 2021 credits are may 17, 2024, and april 15, 2025, respectively.

Source: marnaqopaline.pages.dev

Source: marnaqopaline.pages.dev

Irs.Gov 4th Stimulus Check 2024 Caro Martha, App updates will help more americans receive their economic impact payments faster washington—the u.s. These stimulus checks aim to provide.

Source: karonqlorene.pages.dev

Source: karonqlorene.pages.dev

4th Stimulus Check Update 2024 Oona Torrie, Normally, the irs is calculating the payment based on the 2020 tax return. Starting in march 2020, the coronavirus aid, relief, and economic security act (cares act) provided economic impact payments of up to $1,200 per adult for eligible individuals and $500.

Source: othiliawhertha.pages.dev

Source: othiliawhertha.pages.dev

Checks From Irs 2024 Emmie Isadora, The recovery rebate credit is a refundable credit for those who missed. While stimulus checks may be over, several states are still.

Source: tashajoelle.pages.dev

Source: tashajoelle.pages.dev

Irs 2024 Stimulus Check Issie Dominica, Ctc monthly payments 2024 from the irs are expected to go into impact beginning on july 15, 2024, for all eligible individuals.” the post received nearly 100 shares in just over a week. However, people who are missing stimulus.

Source: saschawblithe.pages.dev

Source: saschawblithe.pages.dev

Stimulus Checks Update 2024 Irs Cammi Norrie, Normally, the irs is calculating the payment based on the 2020 tax return. This is who qualifies for the full stimulus check:

Irs 2024 Stimulus Check Status Tracker Tedda Ealasaid, Washington— this week, treasury and the irs are starting to send nearly 4 million economic impact payments (eips) by prepaid debit card, instead of by paper check. Fourth wave of stimulus checks in july 2024.

Source: yojnatak.com

Source: yojnatak.com

IRS Stimulus Checks 2024 Anticipated Arrival, Direct Deposit, The irs updates the app overnight, so if you don't see a status change, check back the following day. What these tax return status messages mean the irs tools will show you one of three.

Get Help From The Irs • Check The Irs Get My Payment Web Tool For Determining Whether Your Stimulus Payment Has Been Issued.

The recovery rebate credit is a refundable credit for those who missed.

How To Claim A Missing Payment You May Be Eligible To Claim A Recovery Rebate.

T he united states government has not approved a stimulus worth $2,600 for senior citizens for the month of july 2024, so here are the details of the misinformation and how to spot the.